All Categories

Featured

Table of Contents

You can add these to a supply profile to obtain some direct exposure to genuine estate without the initiative of located or vesting bargains. Historically returns have actually been excellent with REITs however there is no guarantee or guarantee and they will certainly fluctuate in worth swiftly. Here are some benefits and negative aspects of REITs: REITs are highly liquid investments because they are traded on stock exchanges, enabling capitalists to buy or market shares any time they want.

REITs go through substantial governing oversight, including reporting demands and compliance with specific earnings distribution regulations. This degree of guideline offers openness and capitalist security, making it a fairly safe option to avoid fraud or undependable operators. Historically, REITs have actually delivered affordable returns, typically comparable to or also exceeding those of stocks and bonds.

Are there budget-friendly Real Estate Crowdfunding For Accredited Investors options?

This can result in possibly greater returns and favorable tax obligation treatment for investors. While REITs can offer diversification, numerous invest in industrial homes, which can be at risk to economic recessions and market variations.

Workplace and multifamily REITs might be encountering substantial disturbance in the coming year with raised interest prices and reduced demand for the property. I have stated sometimes the next chance is most likely commercial property because those are the possessions that have the most space to drop.

How do I apply for Real Estate Syndication For Accredited Investors?

You will never read about these unless you know someone that understands someone who is involved. Comparable to a REIT, these are pools of cash made use of to buy property. Here are some benefits and negative aspects of an exclusive realty fund: Exclusive realty funds can possibly provide higher returns compared to openly traded REITs, and other options, due to the fact that they have the adaptability to spend directly in buildings with the goal of optimizing revenues.

Purchasing a private fund gives you accessibility to a varied profile of real estate properties. This diversification can aid spread threat throughout different home kinds and geographic places. There are many actual estate funds that either concentrate on domestic property or have household real estate as component of the overall profile.

Fund managers are usually professionals in the genuine estate industry. Due to the fact that they do this complete time, they are able to situate better offers than most part-time energetic investors.

These investments are restricted to accredited investors only. The meaning of an approved financier is a little bit more comprehensive than this however as a whole to be certified you need to have a $1 million net worth, exclusive of your key home, or make $200,000 as a solitary tax payer or $300,000 with a spouse or partner for the previous two years.

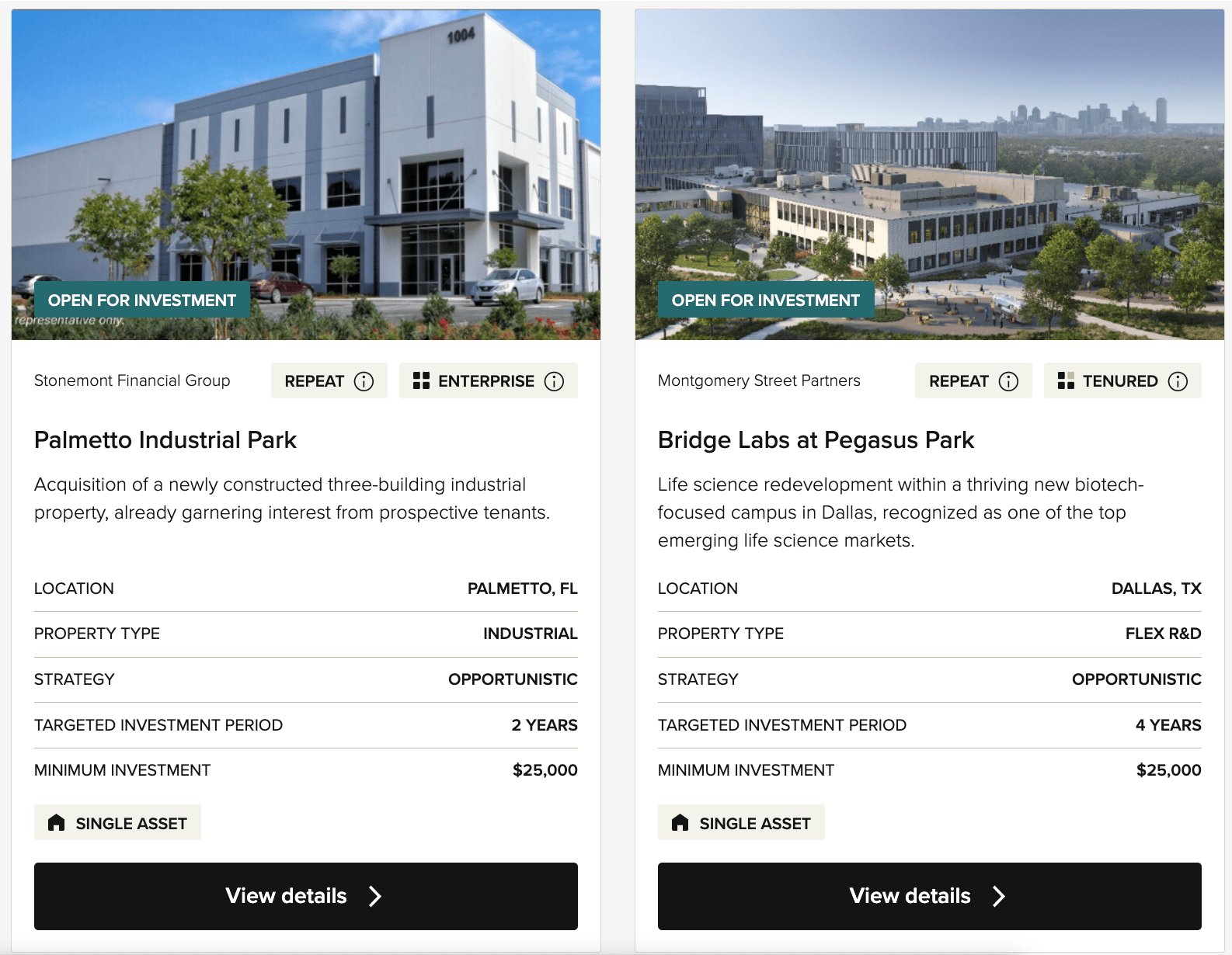

The difference is a fund is commonly purchased numerous projects while submission is generally limited to one. House submissions have been incredibly popular in recent times. Below are some benefits and negative aspects of a syndication: Among the main advantages of lots of realty syndications is that capitalists might have a say in the residential or commercial property's administration and decision-making.

Where can I find affordable Real Estate Investing For Accredited Investors opportunities?

Successful syndications can produce substantial revenues, especially when the building values in value or produces regular rental revenue. Financiers can take advantage of the property's monetary performance. I have actually made returns of over 100% in some submissions I purchased. Syndications can be highly conscious adjustments in rates of interest. When passion prices climb, it can increase the price of financing for the residential or commercial property, potentially impacting returns and the total feasibility of the financial investment.

The success of a submission heavily depends upon the expertise and integrity of the driver or enroller. Current cases of scams in the submission room have raised problems about the dependability of some operators. There are a handful of considerable instances but none smaller sized than the current Give Cardon allegations.

Exiting a submission can be challenging if it is even feasible. If it is permitted, it typically needs finding another capitalist to acquire your risk or else you may be forced to wait up until the residential property is sold or refinanced. With very uncommon exceptions, these investments are scheduled for accredited financiers just.

This is investing in a swimming pool of money that is made use of to make lendings versus real estate (Accredited Investor Real Estate Syndication). Rather than possessing the physical real estate and being subject to that prospective downside, a mortgage fund just invests in the paper and uses the actual estate to safeguard the investment in a worst-case scenario

They generate income through passion repayments on home loans, supplying a predictable cash circulation to financiers. Payments come in regardless of a tenant remaining in area or rental efficiency. The possession does not decline if property worths drop, presuming there is no default, because the asset is a note with a pledge of payment.

This permits for steady month-to-month settlements to the capitalists. Unlike private funds and submissions, home loan funds usually offer liquidity alternatives.

What is the most popular Real Estate Syndication For Accredited Investors option in 2024?

It is not as fluid as a REIT yet you can get your financial investment back if needed. Maybe the biggest benefit to a mortgage fund is that it plays a critical function in improving local neighborhoods. Mortgage funds do this by supplying loans to genuine estate investors for property rehab and advancement.

The one possible disadvantage is that you might be surrendering on possible returns by purchasing a secure asset. If you are ok taking losses and desire to bet for the higher return, one of the other fund alternatives may be a far better fit. If you are searching for some secure diversification a home loan fund may be an excellent enhancement to your portfolio.

How do I apply for Accredited Investor Commercial Real Estate Deals?

The Securities and Exchange Commission (SEC) has specific policies that financiers need to meet, and usually non recognized capitalists don't satisfy these. For those that do, there is an opportunity to spend in start-ups. Crowdfunding systems now supply non certified investors the possibility to purchase equity of startups easily, by bypassing the SEC policies and having the ability to invest with a low upfront resources amount.

Latest Posts

Paying Back Taxes On Property

Buying Delinquent Tax Property

Homes Delinquent Tax Sale