All Categories

Featured

Table of Contents

- – Accredited Investor Real Estate Partnerships

- – What does Accredited Investor Real Estate Deal...

- – How do I exit my Real Estate Syndication For ...

- – Where can I find affordable Accredited Invest...

- – Why are Exclusive Real Estate Crowdfunding P...

- – What are the top Real Estate For Accredited ...

Rehabbing a residence is taken into consideration an energetic investment approach. On the various other hand, passive actual estate investing is fantastic for financiers that desire to take a less involved method.

With these techniques, you can take pleasure in passive revenue over time while allowing your financial investments to be handled by another person (such as a property management company). The only point to remember is that you can lose out on several of your returns by working with somebody else to manage the financial investment.

An additional consideration to make when selecting a realty investing strategy is direct vs. indirect. Similar to energetic vs. easy investing, direct vs. indirect describes the level of involvement needed. Direct financial investments entail actually purchasing or handling homes, while indirect methods are much less hands on. For instance, REIT spending or crowdfunded homes are indirect actual estate financial investments.

Register to go to a FREE on the internet property course and discover just how to get going buying property.] Many investors can get so captured up in determining a building type that they don't understand where to start when it comes to locating a real building. So as you familiarize yourself with various property types, also make sure to discover where and how to discover every one.

Accredited Investor Real Estate Partnerships

There are loads of properties on the market that fly under the radar since capitalists and buyers do not understand where to look. Several of these residential properties experience bad or non-existent advertising and marketing, while others are overpriced when provided and as a result stopped working to receive any focus. This suggests that those capitalists going to sort through the MLS can discover a range of investment possibilities.

This method, capitalists can regularly track or look out to new listings in their target location. For those wondering exactly how to make connections with property agents in their corresponding locations, it is a good idea to go to local networking or real estate occasion. Investors looking for FSBOs will additionally discover it beneficial to collaborate with a property representative.

What does Accredited Investor Real Estate Deals entail?

Financiers can additionally drive via their target areas, searching for signs to locate these residential properties. Bear in mind, determining residential or commercial properties can require time, and capitalists need to be prepared to utilize numerous angles to protect their following deal. For capitalists living in oversaturated markets, off-market residential properties can represent an opportunity to obtain in advance of the competitors.

When it involves looking for off-market buildings, there are a couple of resources financiers must examine first. These include public documents, realty public auctions, dealers, networking occasions, and specialists. Each of these resources represents an unique chance to locate residential or commercial properties in a provided area. Wholesalers are usually mindful of fresh rehabbed residential or commercial properties available at reasonable prices.

How do I exit my Real Estate Syndication For Accredited Investors investment?

There are foreclosures. Regardless of numerous proclamations in the information that repossessions are vanishing, information from RealtyTrac proceeds to show spikes in task around the country. Years of backlogged foreclosures and boosted inspiration for banks to repossess can leave a lot more repossessions up for grabs in the coming months. Investors browsing for repossessions must pay mindful focus to paper listings and public documents to find possible residential properties.

You must take into consideration purchasing realty after discovering the various benefits this possession needs to supply. Historically, realty has done well as a property course. It has a favorable connection with gross residential product (GDP), indicating as the economy grows so does the need for genuine estate. Generally, the constant demand offers genuine estate lower volatility when compared to various other financial investment kinds.

Where can I find affordable Accredited Investor Property Portfolios opportunities?

The reason for this is due to the fact that property has low correlation to various other investment kinds therefore providing some defenses to capitalists with various other asset kinds. Various kinds of property investing are related to different levels of threat, so make certain to discover the right financial investment approach for your objectives.

The process of acquiring home involves making a down settlement and financing the rest of the list price. Therefore, you just pay for a tiny percent of the building in advance yet you control the entire investment. This kind of take advantage of is not available with other investment types, and can be used to additional grow your investment profile.

Due to the broad selection of alternatives readily available, numerous capitalists most likely discover themselves wondering what really is the finest real estate investment. While this is an easy concern, it does not have an easy response. The most effective kind of investment residential or commercial property will certainly depend on many variables, and financiers should take care not to eliminate any type of options when looking for potential deals.

This write-up discovers the opportunities for non-accredited investors aiming to endeavor into the lucrative world of actual estate (Passive Real Estate Income for Accredited Investors). We will look into numerous financial investment avenues, regulative considerations, and methods that encourage non-accredited individuals to harness the potential of genuine estate in their investment profiles. We will also highlight just how non-accredited financiers can work to come to be accredited capitalists

Why are Exclusive Real Estate Crowdfunding Platforms For Accredited Investors opportunities important?

These are usually high-net-worth people or companies that meet accreditation demands to trade exclusive, riskier investments. Earnings Standards: People need to have a yearly earnings exceeding $200,000 for 2 successive years, or $300,000 when integrated with a spouse. Net Worth Requirement: A web worth exceeding $1 million, omitting the main home's value.

Investment Expertise: A clear understanding and awareness of the threats connected with the investments they are accessing. Paperwork: Ability to offer economic statements or other documentation to verify earnings and total assets when requested. Property Syndications require accredited investors since enrollers can only allow accredited capitalists to subscribe to their investment opportunities.

What are the top Real Estate For Accredited Investors providers for accredited investors?

The very first usual mistaken belief is once you're a certified investor, you can keep that standing forever. To become an accredited capitalist, one need to either hit the revenue criteria or have the internet worth requirement.

REITs are attractive due to the fact that they generate more powerful payouts than typical stocks on the S&P 500. High return rewards Portfolio diversity High liquidity Rewards are exhausted as regular earnings Sensitivity to rates of interest Threats related to certain buildings Crowdfunding is a technique of on-line fundraising that includes asking for the public to add cash or start-up resources for brand-new tasks.

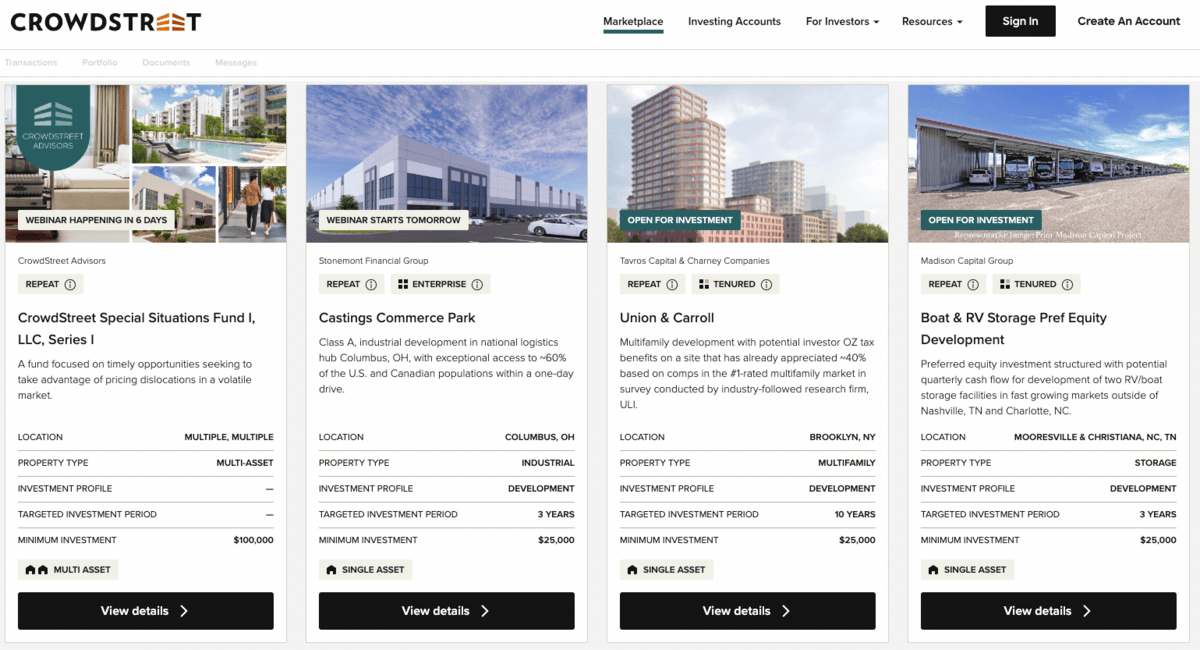

This enables entrepreneurs to pitch their ideas straight to everyday web users. Crowdfunding offers the capability for non-accredited financiers to end up being investors in a business or in a property residential property they would certainly not have actually had the ability to have accessibility to without accreditation. Another advantage of crowdfunding is portfolio diversification.

The 3rd advantage is that there is a reduced barrier to entrance. In some instances, the minimum is $1,000 dollars to purchase a business. Oftentimes, the investment seeker requires to have a performance history and remains in the infancy stage of their job. This might mean a greater danger of losing an investment.

Table of Contents

- – Accredited Investor Real Estate Partnerships

- – What does Accredited Investor Real Estate Deal...

- – How do I exit my Real Estate Syndication For ...

- – Where can I find affordable Accredited Invest...

- – Why are Exclusive Real Estate Crowdfunding P...

- – What are the top Real Estate For Accredited ...

Latest Posts

Paying Back Taxes On Property

Buying Delinquent Tax Property

Homes Delinquent Tax Sale

More

Latest Posts

Paying Back Taxes On Property

Buying Delinquent Tax Property

Homes Delinquent Tax Sale